Data on physician searches offers bright spot amid evidence that shortages are making recruiters' lives miserable

Plus: Healthcare executives' rising salaries point to systems’ improved performance, report says

Job creation in healthcare last month was the only reason the U.S. economy reported any job growth at all for October, according to Bureau of Labor Statistics data.

Healthcare saw 52,000 new jobs created in October, on par with the past year’s monthly average of 58K new jobs, noted Health Leaders Media.

Comprising that total were 36K jobs created in ambulatory services, 9,000 created in nursing homes and residential care services, and 8,000 created in hospitals.

Across the entire economy, the total number of new jobs created last month was just 12,000. How, you ask? Well, manufacturing jobs dropped by nearly 50K and temp jobs in professional services fell by about the same number. Other industries stayed about the same, BLS said.

Healthcare counted 17.8 million workers in October, about 1% more than the same period a year ago, BLS reported.

More physician searches were filled last year but number of searches is still rising

According to annual research by the Association for Advancing Physician and Provider Recruitment (AAPPR), the percentage of physician searches deemed successful — i.e., resulting in a position being filled — rose last year for the first time in five years.

The data on recruitment searches for physicians and advanced practice providers (APP) was released October 29 in AAPPR’s annual Internal Physician and Provider Recruitment Benchmarking Report, which analyzed data from 150 health organizations and their 17,000-plus searches. 58% of all searches last year were specifically for physicians, according to AAPPR’s news release.

The number of active physician searches for organizations per year continues to increase, the report said. Advanced practice provider searches also continue to increase as the physician shortage grows; APP searches make up more than half of all searches per department.

At the same time, the number of recruitment staff decreased for the first time since 2020, and nearly one in five recruiters left their positions in 2023.

The full report is available for purchase at AAPPR’s website, though the organization included a number of key findings in its public release:

10% of all physician searches were for Family Medicine, the most common type of search.

81% of all healthcare organizations searched for a Family Medicine physician in 2023.

The next most common searches were Hospital Medicine (9%), OB/GYN (6%), and Internal Medicine (5%).

83% of physicians accepted job offers in 2023, representing an increase after years of declining success rates.

APPs accepted 71% of offers extended to them, according to the report.

The median time to hire physicians — measured from search launch to signed contract — varied widely by specialty, ranging from 77 to 228 days.

Turnover among physicians and APPs has decreased year-over-year but is still higher than 2019 and 2020.

Satisfaction with compensation among recruitment professionals decreased to 55% in 2023, compared to 67% who rated their compensation as “Good” or “Excellent” in 2019.

Learn more at https://aappr.org/research/benchmarking/.

New Jersey bill requires unemployment offices to funnel filers to healthcare jobs

New Jersey state lawmakers are considering a bill that would “require the state Department of Labor & Workforce Development to identify and help recruit unemployed individuals for jobs in healthcare facilities, home healthcare and hospice settings,” according to a report from the New Jersey Business & Industry Association (NJBIA).

NJBIA last week threw its support behind the bill, A4809; it calls for the state to spend $250,000 on training programs and resources for eligible individuals. Sponsored by three Democrats, A4809 was passed out of the New Jersey Assembly Labor Committee and sent to the Appropriations Committee with amendments last week; a similar version is moving through the state Senate.

New Jersey is projected to have a shortage of 24,000 registered nurses by 2027 — the fourth-largest shortage in the country — according to the federal Health Resources and Services Administration. The state already has a critical shortage of certified nursing assistants or CNAs, NJBIA said.

“This legislation demonstrates one way that workforce development can truly be accomplished using our existing state infrastructure to address a very real workforce gap,” NJBIA Vice President of Government Affairs Althea D. Ford said in her written testimony. Ford said the legislation would effectively use the resources of the unemployment offices and workforce development services to by “connecting prospective workers to employment opportunities in an in-demand field.”

Survey: Rising executive salaries, incentives reflect demand and competition for talent

Workforce consulting firm SullivanCotter recently published results from its annual healthcare management and executive compensation survey, one of the industry’s most comprehensive with data from over 45,000 professionals.

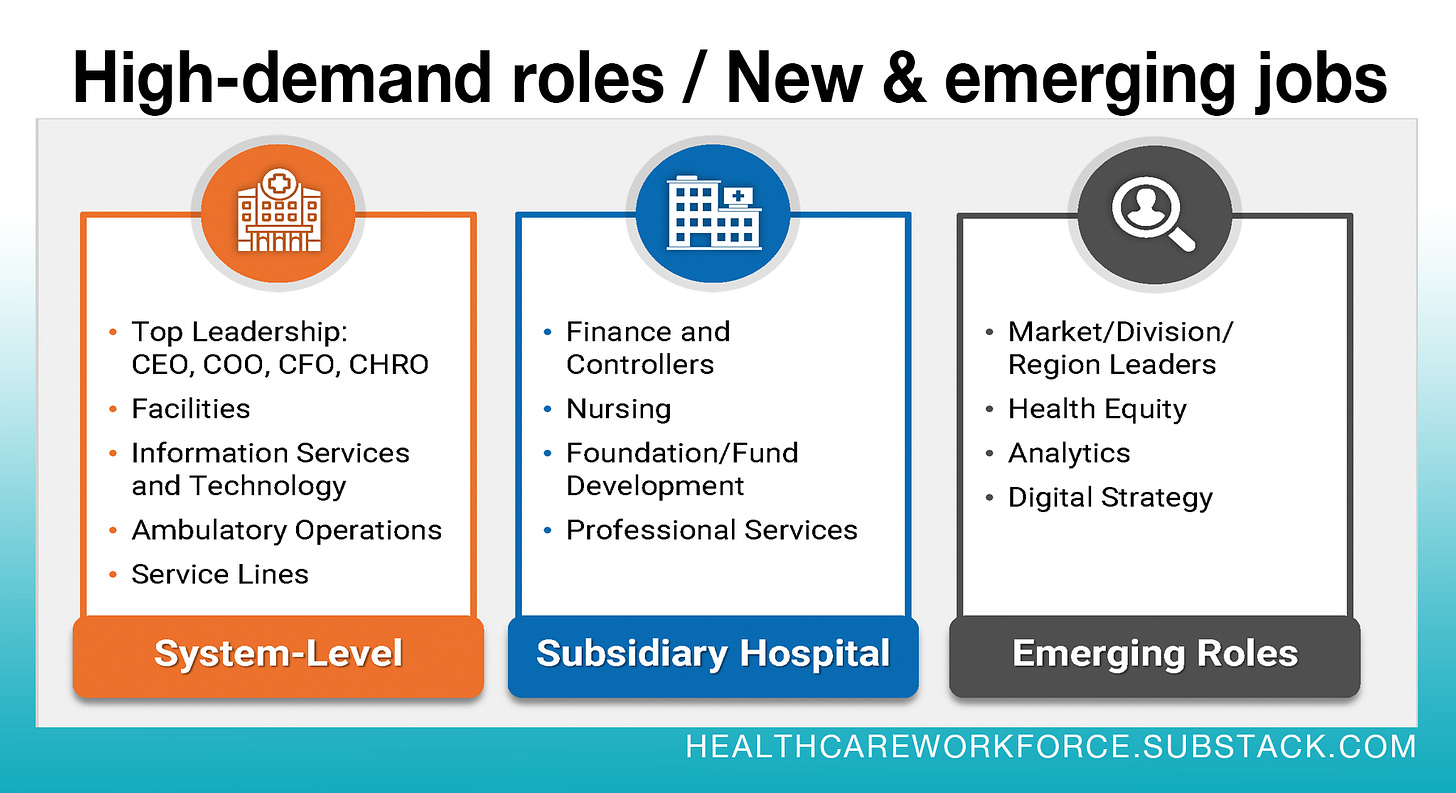

The results of the 2024 Health Care Management and Executive Salary Survey show that executive salaries rose by an average of 4.6% this year, surpassing the 4.4% growth seen in 2023, according to a SullivanCotter news release. The median pay increase for executives at the system level was 5.2% while the median increase for executives at subsidiary hospitals was 3.5%.

“The industry is experiencing a critical gap in expertise as operations grow more complex and leaders retire or continue to step away,” said SullivanCotter’s Bruce Greenblatt in the news release. “The pool of qualified executive talent is increasingly limited, and this is placing upward pressure on total compensation – particularly via higher base salaries.”

Health system positions with the biggest pay increases were roles focusing on business strategy, information technology and security, integration, care delivery excellence and legal/regulatory compliance, according to the report.

Incentive awards increased even more, indicating that health systems’ performance in 2023 reached or exceeded their targets.

“Although performance is improving year-over-year and payouts approximate target, we still saw about half of organizations change their annual incentive plans for the 2024 fiscal year. This included a refined approach to goal calibration and increased weighting of financial and system-wide performance metrics – highlighting the need to focus on financial sustainability, integration, and refined care delivery models to move forward in a post-COVID environment,” said Tom Pavlik, Managing Principal, SullivanCotter.

Shout-out to HWR sponsors

The Healthcare Workforce Report newsletter is generously supported by MedCerts.

For information on supporting HWR, email HealthcareWorkforce@substack.com.